The report on money transfer services provides a comprehensive analysis of the market, covering the historical period of 2019-2024 and the forecast periods of 2024-2029 and 2029-2034. It evaluates the market by region and major economies, offering insights into trends and growth drivers.

Market Overview

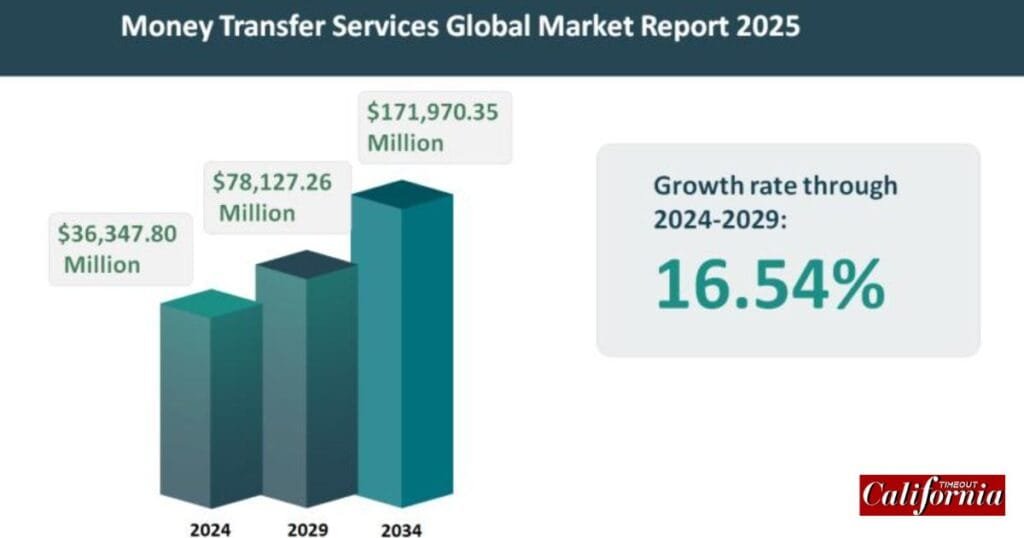

The global money transfer services market reached a value of approximately $36.34 billion in 2024, growing at a compound annual growth rate (CAGR) of 16.02% since 2019. It is projected to expand to $78.12 billion by 2029 at a CAGR of 16.54%. From 2029, the market is expected to grow at an accelerated CAGR of 17.09%, reaching $171.97 billion by 2034.

Money transfer services facilitate secure electronic transfers of funds between individuals, businesses, or organizations, both domestically and internationally. These services are a cornerstone of the global financial ecosystem, enabling efficient, reliable, and accessible financial transactions.

Strategies Adopted by Key Players

Leading companies in the money transfer services market are employing a variety of strategies to capture opportunities and meet market demands. These include:

- Direct Payments: Forming partnerships to enable instant wallet and bank transfers.

- Cross-Border Payments: Collaborating on seamless global payment solutions.

- Fast Transfers: Introducing products for real-time, delay-free money transfers.

- Market Expansion: Using mergers and acquisitions (M&A) to enter new regions and expand offerings.

- Digital Payments: Partnering to capitalize on the rapidly growing digital payments market.

Suggested Strategies for Companies

To seize emerging opportunities, The Business Research Company recommends that money transfer services providers adopt the following approaches:

- Secure Transfers: Develop advanced systems for safe international money transfers.

- Digital Platforms: Transform global fund transfers with innovative digital technologies.

- Low-Cost Payments: Create affordable solutions for cross-border transactions.

- Merchant Services: Offer flexible and secure payment options tailored to merchants.

- Blockchain Integration: Leverage blockchain technologies, such as Solana, to improve international payments.

- Real-Time Payments: Enhance infrastructure to support instant, real-time payment processing.

Top Companies in the Market

The top ten competitors accounted for 29.18% of the total market share in 2023. The Western Union Company led the market with an 11.49% share, followed by:

- Wise (TransferWise Ltd.)

- Revolut Ltd.

- Remitly Inc.

- MoneyGram International Inc.

- PayPal Holdings Inc.

- WorldRemit Ltd.

- Intermex Wire Transfer

- Paytm (One97 Communications Limited)

- OFX (OzForex)

Opportunities for Growth

The market offers significant opportunities for companies to innovate and expand. Advanced digital solutions, blockchain technology, and real-time payment infrastructure are key areas where providers can differentiate themselves and deliver enhanced value to consumers and businesses alike.